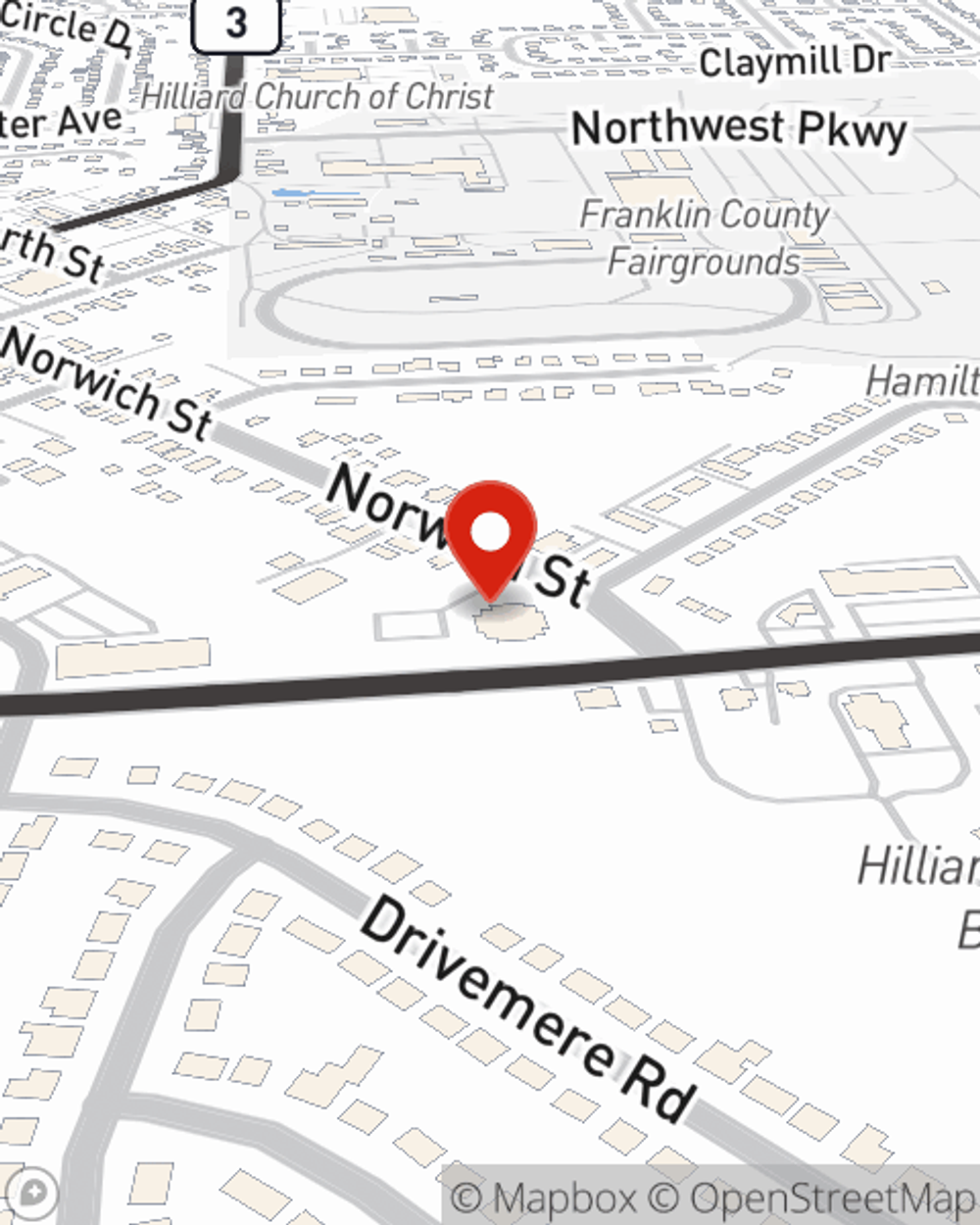

Renters Insurance in and around HILLIARD

Welcome, home & apartment renters of HILLIARD!

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

Renting a home comes with plenty of worries. You want to make sure what you own is protected in the event of some unexpected accident or trouble. And you also need liability protection for friends or visitors who might become injured on your property. State Farm Agent Dee Miller is ready to help you handle the unexpected with reliable coverage for your renters insurance needs. Such thoughtful service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If mishaps occur, Dee Miller can help you submit your claim. Keep your home in a rental-sweet-rental state with State Farm!

Welcome, home & apartment renters of HILLIARD!

Coverage for what's yours, in your rented home

Open The Door To Renters Insurance With State Farm

The unexpected happens. Unfortunately, the valuables in your rented space, such as a tablet, a laptop and a coffee maker, aren't immune to burglary or fire. Your good neighbor, agent Dee Miller, has the knowledge needed to help you figure out a policy that's right for you and find the right insurance options to help keep your things protected.

Call or email State Farm Agent Dee Miller today to explore how the leading provider of renters insurance can protect items in your home here in HILLIARD, OH.

Have More Questions About Renters Insurance?

Call Dee at (614) 876-5717 or visit our FAQ page.

Simple Insights®

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

Simple Insights®

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.